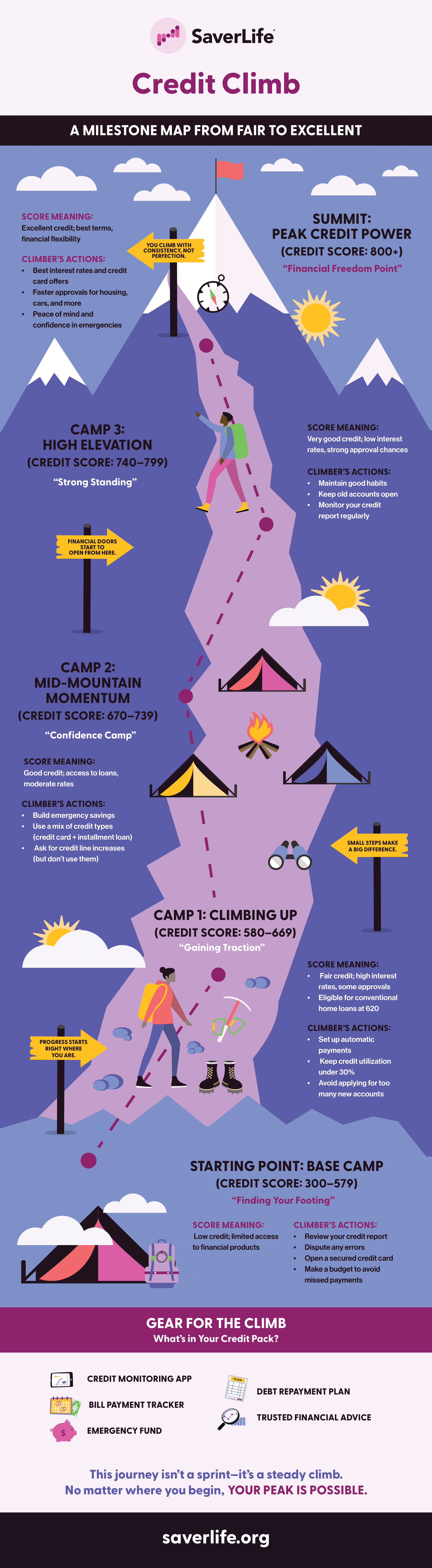

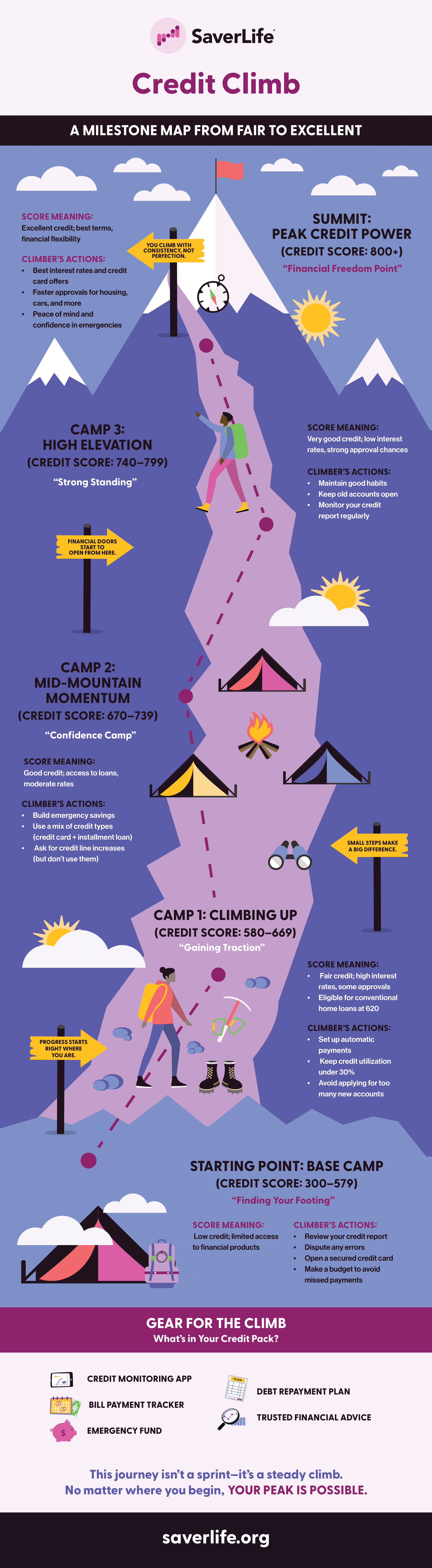

Credit climb: A milestone map from fair to excellent

Every step you take builds momentum. Stay consistent, celebrate milestones, and keep moving upward—because the view from excellent credit is worth the climb.

Welcome to SaverLife

Every step you take builds momentum. Stay consistent, celebrate milestones, and keep moving upward—because the view from excellent credit is worth the climb.

Interest rates go up and down depending on how the economy’s doing. When rates are high, saving money becomes more rewarding. When they’re low, borrowing (like using credit cards or taking out loans) gets cheaper, so people tend to spend more. That’s why it’s always smart to take a quick look at where your money… Read more

For potential homeowners, your rent is the most similar (and likely the largest) monthly obligation. So here’s a question: Shouldn’t you get credit – pun fully intended – for making those on-time payments? Even if you’re not actively house hunting, your credit score plays a huge role in your financial life. A strong score can… Read more

First, let’s start with the facts. There’s a widespread fallacy that a score determines whether or not you get credit. The truth is that lenders use a variety of factors to make credit decisions. These factors include your FICO scores, but also take into account your income, your employment history, and your credit history. This… Read more